Everything You Need to Know About CMA Practical Training.

Everything You Need to Know About CMA Practical Training.

If you're preparing for the CMA Final exams, one important aspect you cannot ignore is Practical Training, and every aspirant must understand the full picture, not just the updates, but the entire structure of practical training.

Let’s break it down into essential parts of practical training to help you plan better and stay ahead in your CMA journey.

1. Who Needs to Do Practical Training and When?

1. Who Needs to Do Practical Training and When?

Practical Training is mandatory only for CMA Final students. If you are appearing for the Foundation or Inter exams, you are not required to complete this training.

At the Final level, there are two groups – Group 3 and Group 4. Students have two options:

Appear for both groups together

Appear group-wise, i.e., one group at a time

According to ICMAI:

If you're appearing for both groups together, you must complete the entire 15 months of training before filing your exam form.

If you're appearing group-by-group, you can appear for one group without training, but for the other group, you must complete 15 months of training before submitting the exam form.

In simple terms, training is required only at the time of CMA Final exam, and not before that.

2. How Long is the Training, and By When Should It Be Done?

The total training duration is 15 months.

Let’s say you’re preparing for the December term exam:

Exam forms are generally submitted in September.

You must complete at least 10 months of training by August 31.

The remaining 5 months should be completed by February 10, before the result is declared.

Why do these dates matter?

ICMAI checks your training status at two points:

During admit card generation (10 months check)

Before result declaration (15-month check)

Pro Tip: Instead of waiting till February, try to complete all 15 months by August 31 itself. That way, you can dedicate your entire time after that to revision and exam preparation without worrying about completing your training.

For the June term, the logic is the same: try to finish your 15 months by February, even though only 10 months are officially required then.

3. Where Can You Do Practical Training?

3. Where Can You Do Practical Training?

There are two primary options to complete your training:

CMA Firms – These are cost accountancy firms registered with the ICMAI.

Companies with Eligible Turnover:

₹50 Lakhs for manufacturing companies

₹25 Lakhs for service companies

This opens the door for literally any organization across the country (or even abroad) that meets this criterion. Even your family business could qualify if it’s officially documented.

4. What If You’ve Already Worked Somewhere?

4. What If You’ve Already Worked Somewhere?

If you’ve already worked in an eligible organization for 15 months or more, you don’t need to do fresh training. You just need to get your previous work experience validated and approved by the Institute.

However, during the revision phase (3 months for one group, 6 months for both groups ideally), it is highly recommended to take a break from training or work to fully focus on revision.

Lack of revision is one of the key reasons why students miss out on passing, even when they've completed training.

5. How to Find the List of Organizations for Practical Training?

5. How to Find the List of Organizations for Practical Training?

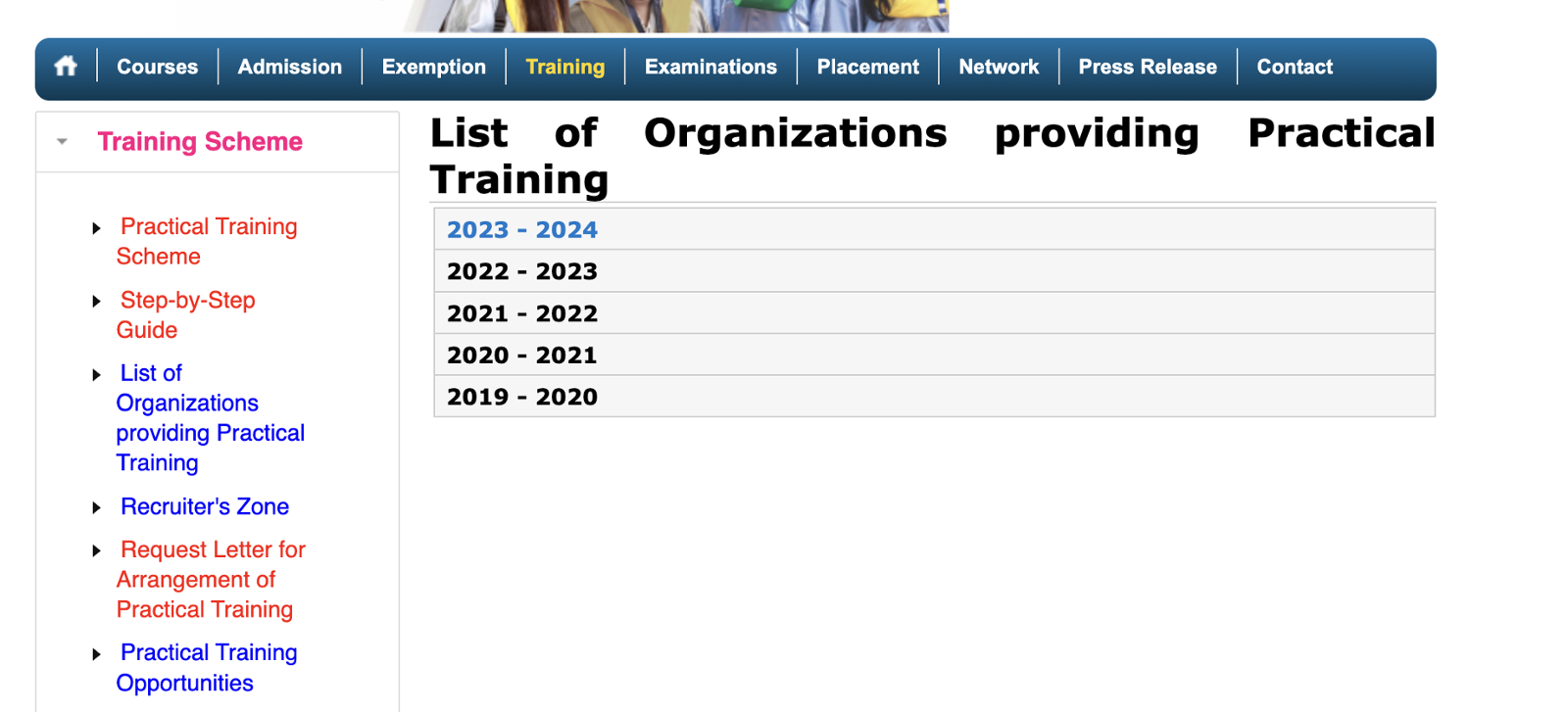

1. Search "Just Practical Training CMA" on Google – You'll find a dedicated ICMAI page.

2. List of Organizations – Click the link for "List of Organizations Providing Practical Training."

3. Annual Updated Lists – ICMAI updates the lists year-on-year.

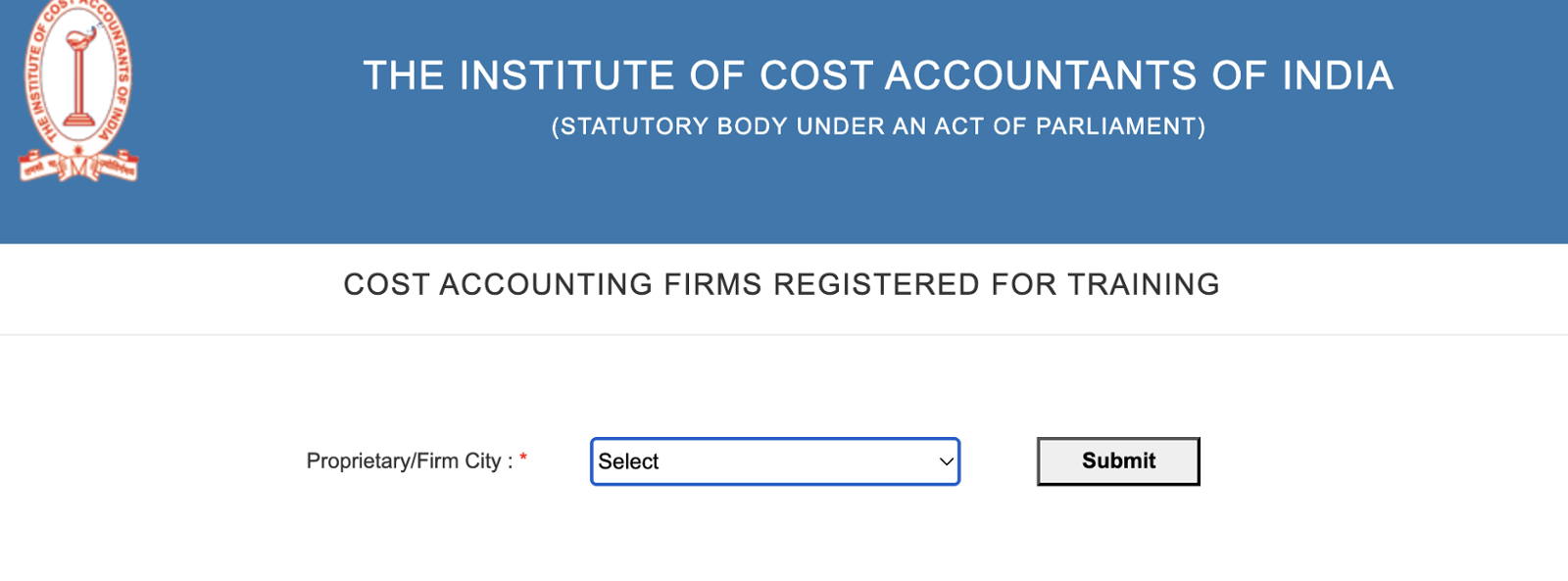

4. Practicing Cost Management Accountants (PCMA) – City-wise list available.

5. Government Organizations – Compiled based on student placements.

6. Say No to Dummy Training

6. Say No to Dummy Training

Dummy training might look easy, but it's not worth it in the long run. Companies want to know what you did during training. If you have no experience to show, your interview performance suffers.

One of our students ranked in the Top 10 but took up real training immediately after exams – that’s what built credibility.

7. Eligible Areas of Training

7. Eligible Areas of Training

Approved training areas include:

Cost, Financial & Management Accounting

Financial Management & Auditing

Direct and Indirect Taxes

Regulatory Compliance

Systems & IT (ERP, SAP, BI tools)

Project Management

Banking, Insurance & Insolvency

Teaching (Finance, Tax, Cost)

Engineering, Project Planning, Quality, SCM

Any ICMAI-approved domain

Choose based on your career goals.

8. Forms & Documentation

8. Forms & Documentation

Once training begins, students must inform the Institute within 30 days by submitting

T-3 – For CMA firms

T-4 – For non-CMA organizations

Have you already worked?

T-3 – Declare past experience and get exemption

If Completed :

T-5B – Use to submit after 15 months

Big Companies vs Small Firms

Big Companies (PSUs/MNCs) – Good branding, limited scope

Small Firms – Broader exposure, better learning

If you're aiming for your own consultancy, go small. If looking for jobs, big names help.

Read this as well: Practical Training in the New scheme

Big Companies (PSUs/MNCs) – Good branding, limited scope

Small Firms – Broader exposure, better learning

If you're aiming for your own consultancy, go small. If looking for jobs, big names help.

Read this as well: Practical Training in the New scheme

9. How much Stipend do you get?

9. How much Stipend do you get?

ICMAI recommends ₹10,000–₹25,000/month

Reality:

CA firms: ₹2,000–₹5,000/month

Companies: ₹10,000–₹15,000/month (if skilled)

Upskill in Tally, GST, Excel, ITR – It improves stipend!

Read this as well: CMA Exams over? Upskill yourself with Power-Packed Skill Courses.

10. How to Apply for Training?

10. How to Apply for Training?

Use ICMAI lists or other job portals

Keep applying actively

Improve your CV – add practical skills

Even unpaid internships count if they build your profile

Use ICMAI's request letter format to apply to new firms.

11. Get Help from SJC – A Practical Training Initiative for CMA Students

11. Get Help from SJC – A Practical Training Initiative for CMA Students

As you now know, CMA students are required to undergo 15 months of practical training after clearing their Intermediate level, as per ICMAI guidelines. However, one of the major challenges students face is finding a suitable company that meets the eligibility criteria for training.

While the Institute mandates that the training must be done in organizations with a turnover of ₹25–50 lakhs, students often find limited opportunities. As a result, many choose to work in CA firms or prefer roles in accounting and compliance-related fields.

To support students in this phase, SJC has launched a dedicated training initiative. This program is designed for CMA aspirants who wish to build their practical knowledge and skillset in areas like TDS, GST filings, payroll processing, and other real-world finance and compliance functions.

The training spans 2 to 3 months, with a commitment of 3 hours per day, 6 days a week. This structure ensures that students gain in-depth exposure to key concepts and practices. Upon successful completion of this program, SJC also facilitates guaranteed placements with stipends in students’ preferred cities or domains.

In addition to technical learning, grooming and soft skills sessions are provided to prepare students for real interviews and workplace expectations. Through this initiative, SJC aims to expand students’ career opportunities and help them explore practical roles beyond traditional CMA career paths. For any information regarding this opportunity get in contact with us at : 8100 11 2222.